The circular flow of income is a fundamental concept in economics that shows the movement of money and goods in an economy. It represents the flow of money between different sectors, including households, businesses, the government, and the foreign sector. This flow of income is a continuous cycle in which money circulates through the economy, supporting the production and consumption of goods and services. Understanding the circular flow of income is crucial for analyzing the functioning of an economy and how different agents (households, firms, governments, and foreign entities) interact with each other. In this article, we will explore the concept of the circular flow of income, its key components, and how it illustrates the movement of money within an economy.

The circular flow of income is a model used to explain the movement of income and expenditure in an economy. It shows how money flows between different sectors and how economic activities such as production, consumption, and investment create a continuous cycle of income distribution. The circular flow model helps to visualize how economic agents interact with each other and how their decisions influence the overall economy. At its core, the model illustrates the flow of money in exchange for goods and services between households and businesses, as well as the role of government and foreign trade in this system.

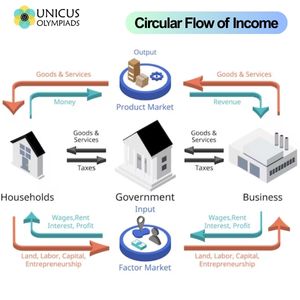

The basic circular flow model consists of two main sectors: households and businesses. In this simple version of the model, households provide factors of production, such as labor, capital, and land, to businesses. In return, businesses pay households wages, rents, interest, and profits, which are collectively known as income. Households then use this income to purchase goods and services produced by businesses, completing the cycle. This flow of money, income, and goods creates a continuous loop that drives economic activity.

The movement of money in the circular flow model represents the exchange of income for goods and services in an economy. This flow occurs in two main directions: the flow of money for goods and services (expenditure) and the flow of income in exchange for factors of production. These two flows create a continuous cycle that sustains economic activity and supports the production and consumption of goods and services.

In the circular flow of income, households spend their income on the goods and services produced by businesses. This expenditure is the flow of money from households to businesses. Businesses then use the revenue from this expenditure to pay for factors of production (labor, capital, land, etc.) provided by households, completing the cycle.

On the other side of the cycle, businesses pay households for the factors of production they provide. This is the flow of income from businesses to households. In return, households use this income to purchase goods and services, creating the flow of money back to businesses.

The government plays a crucial role in the circular flow of income by influencing both the production and consumption sides of the economy. Governments collect taxes from households and businesses and redistribute this income in various forms. Taxes reduce the amount of money households and businesses have to spend, while government spending on public goods and services increases the flow of money back into the economy.

The government provides public goods and services such as roads, schools, healthcare, and defense. These goods are not produced by private businesses but are essential for the functioning of society. Government spending can stimulate economic activity by injecting money into the economy, especially during times of recession or low growth.

The government collects taxes from households and businesses, which reduces the amount of disposable income available for spending. However, the government also provides transfers, such as social security benefits, unemployment benefits, and subsidies, which help support household consumption and redistribute income. These transfers increase household income and boost the demand for goods and services.

The foreign sector represents the rest of the world and is involved in international trade. The foreign sector buys exports from domestic businesses, providing revenue to those businesses. In return, households and businesses in the domestic economy purchase imports from other countries, leading to an outflow of money from the domestic economy. The interaction between the domestic economy and the foreign sector is crucial for understanding the global interconnectedness of economies.

When domestic businesses sell goods and services to foreign countries, they receive payment in the form of foreign currency, which is converted to the domestic currency. This inflow of money from exports supports economic growth by increasing the revenue of businesses and creating jobs in the export sector.

When households and businesses in a country purchase goods and services from foreign countries, money flows out of the domestic economy. This outflow represents the demand for foreign goods and services, which can affect the balance of trade and the overall economic performance of a country. If a country imports more than it exports, it runs a trade deficit, which can have implications for its currency and economy.

The circular flow of income model provides valuable insights into the functioning of an economy. It shows how money circulates through various sectors and how income is generated, distributed, and spent. Understanding the circular flow helps economists and policymakers assess the health of the economy, identify potential issues such as inflation or recession, and formulate strategies to stimulate growth or manage economic downturns.

When the circular flow of income is functioning smoothly, it supports economic growth and stability. High levels of consumption, investment, and government spending contribute to the expansion of the economy, creating jobs, increasing income, and promoting higher standards of living. A healthy circular flow leads to increased production and the efficient allocation of resources, fostering long-term economic prosperity.

Disruptions to the circular flow of income, such as a decline in consumer spending, a reduction in government expenditure, or a decrease in exports, can lead to a slowdown in economic activity. For instance, during recessions, the circular flow may slow down due to reduced consumption and investment, leading to lower demand for goods and services, rising unemployment, and lower national income.