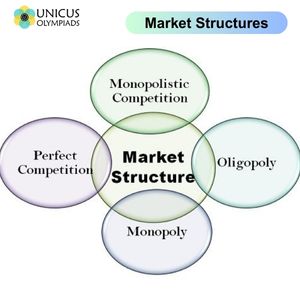

Market structure refers to the characteristics and dynamics of a market, particularly in relation to the number of firms, the nature of competition, the level of product differentiation, and the ease of entry or exit. Understanding market structures is essential for analyzing how pricing is determined in different types of markets. The structure of a market influences how firms set prices, how much competition exists, and how consumers respond to market changes. There are four primary types of market structures: perfect competition, monopolistic competition, oligopoly, and monopoly. Each of these structures has a distinct impact on pricing and the behavior of producers and consumers.

Perfect competition is an idealized market structure where numerous firms sell identical products, and no single firm has the power to influence the market price. In a perfectly competitive market, firms are price takers rather than price makers. The price of goods and services is determined entirely by supply and demand, with no firm able to set prices above or below the market equilibrium.

In a perfectly competitive market, firms are unable to set their own prices. Instead, they must accept the market price, which is determined by the forces of supply and demand. If a firm tries to charge more than the market price, consumers will simply buy from other firms, leading the firm to lower its price back to the equilibrium level. Similarly, if a firm sets its price too low, it will attract more consumers but may not cover its production costs, leading to losses.

Monopolistic competition is a market structure where many firms sell products that are similar but not identical. These products are differentiated in some way, such as through branding, quality, features, or customer service. While firms have some degree of market power, they still face competition from other firms offering similar products. This structure is common in markets for consumer goods, such as clothing, food, and entertainment.

In monopolistic competition, firms have some degree of price-setting power because their products are differentiated. This means that firms can charge slightly higher prices than the prices set in perfect competition. However, because there are many competitors offering similar products, firms cannot charge excessively high prices without losing customers to other brands.

An oligopoly is a market structure characterized by a small number of large firms that dominate the market. In this type of market, each firm has significant market power and can influence prices, but their actions are interdependent. This means that the decisions made by one firm, such as changing prices or introducing a new product, can affect the other firms in the market. Oligopolies are common in industries such as telecommunications, automobiles, and airlines.

In an oligopoly, firms can influence the price of products, but their pricing decisions are often affected by the actions of their competitors. If one firm lowers its prices, others may follow suit to remain competitive. This can lead to price wars, where firms continuously lower prices to gain market share. Alternatively, firms may engage in tacit collusion, where they coordinate prices without formally agreeing to do so, allowing them to maintain higher prices.

A monopoly is a market structure in which a single firm dominates the entire market for a particular product or service. The firm is the sole producer of the product and has significant control over pricing, production, and supply. Monopolies are rare in free-market economies due to anti-trust laws, but they can still exist in certain industries, such as utilities, where the high cost of infrastructure makes it inefficient for multiple firms to operate.

In a monopoly, the price is determined by the monopolist, who can set it as high as the market will bear. Since there is no competition, the monopolist has little incentive to lower prices or improve products. Monopolists can earn large profits by charging higher prices than would be possible in a competitive market, often resulting in inefficiencies and a loss of consumer welfare.